by Sharai Lavoie | Nov 13, 2025 | Federally Qualified Health Centers

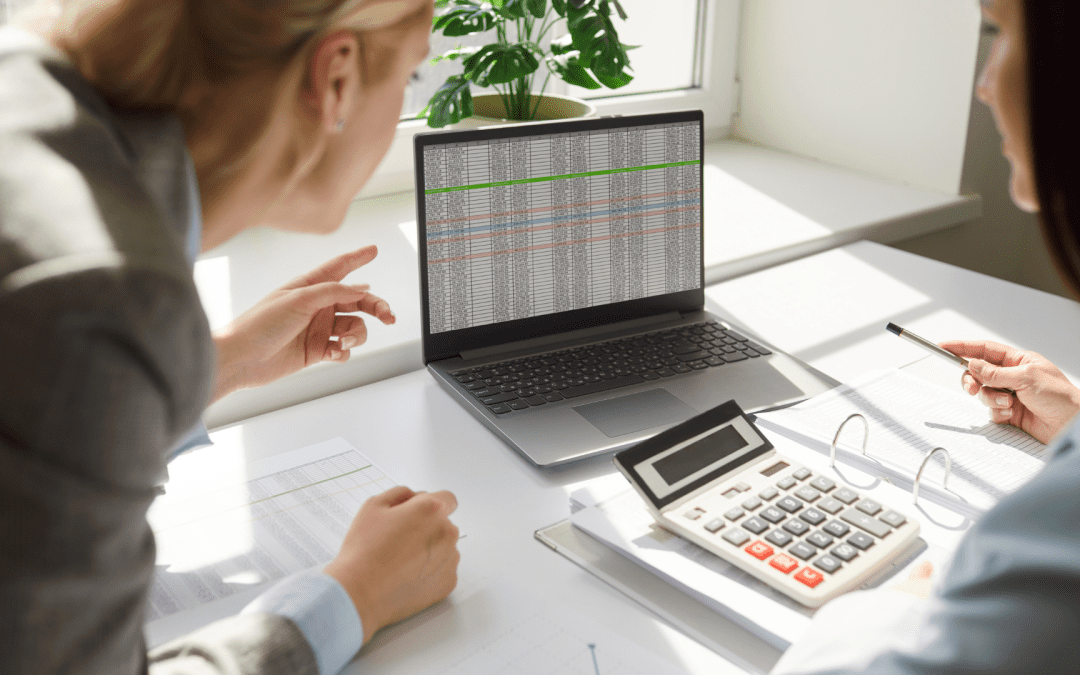

When the CFO of a growing Federally Qualified Health Center opened her monthly report, she realized she was always looking backward. By the time financial statements were ready, staffing decisions had already been made, budgets adjusted, and opportunities missed. The numbers were accurate, but they weren’t timely. That lag between what happened and what was known had become the organization’s biggest blind spot.

This scenario plays out in many FQHCs. Reports are delivered after the fact, disconnected from operations, and too static to guide daily decisions. But when financial and operational data come together in real time, everything changes. Visibility becomes a strategic asset, not just for finance, but for the entire leadership team.

The Risk of Running Without Visibility

Every decision a health center makes, hiring, expansion, or purchasing, depends on data. Yet too often, that data lives in silos. The accounting system knows one thing, the EHR another, and grant reports tell a third story. When leaders don’t have unified, up-to-date information, they make choices based on instinct or outdated assumptions.

The result? Overspending in one department while another struggles with shortages, missed reimbursement opportunities, and reactive budgeting cycles. In a sector where margins are already tight, guessing is expensive. The lack of integrated data doesn’t just delay insight; it directly affects patient care.

When Data Becomes a Decision Tool

One FQHC we worked with decided to change the way it viewed information. Instead of treating reports as a monthly chore, they began using real-time dashboards connected across finance, operations, and clinical metrics. Within weeks, leaders were tracking revenue per encounter, payer mix, and cost per visit side by side.

That visibility created momentum. They could instantly see which programs were over budget, which payer contracts were most profitable, and how staffing shifts affected revenue. The CFO no longer needed to wait for the close to understand performance; she could anticipate outcomes mid-cycle and adjust before small issues became financial strain.

From Reactive to Proactive Leadership

Real-time data isn’t just about better numbers; it’s about better timing. When leaders see problems as they develop, they have the power to fix them early. Forecasting becomes more accurate, budgets more realistic, and operations more predictable.

This proactive approach also builds trust across the organization. Clinical and finance teams begin to speak the same language, aligning decisions around shared data rather than competing priorities. What once felt like two separate worlds, care delivery and financial management, start operating as one system.

Creating Insights That Drive Action

Collecting data is easy; using it wisely takes strategy. The most successful FQHCs define clear metrics that align with their mission, such as access to care, cost per visit, and patient outcomes, and build reporting systems that bring those numbers together.

Dashboards become less about tracking and more about translating data into direction. When every department can see how its performance connects to the organization’s goals, decisions become faster, more confident, and more consistent. That’s what it means to turn data into action.

Partnering for Insight That Moves You Forward

At Lavoie CPA, we help FQHCs integrate financial and operational data so leaders can make informed, real-time decisions. From connecting financial dashboards to refining reporting dimensions, our goal is to give you the clarity to lead with confidence, not just react to numbers after the fact.

If your organization is ready to turn visibility into strategy and strategy into impact, Start the conversation with Lavoie CPA today.

by Sharai Lavoie | Nov 13, 2025 | Federally Qualified Health Centers

In the world of community health, margins are thin and missions run deep. Federally Qualified Health Centers operate at the intersection of compassion and compliance, where every dollar and every hour matters. Yet many centers still rely on fragmented financial systems that quietly drain resources and staff time.

By automating financial operations, clinics don’t just reduce administrative burden—they reclaim capacity. The hidden ROI lies not in cost savings alone, but in empowering teams to deliver better care with less friction.

The Real Cost of Administrative Overload

It’s not just paperwork; it’s time, focus, and energy. When staff are constantly pulled between clinical and administrative responsibilities, the entire organization feels it. Burnout increases, patient experience suffers, and financial performance becomes harder to control.

Many FQHCs operate under the assumption that more hands will solve the problem. Yet without addressing the root cause, manual, disconnected financial workflows, adding people only delays the same inefficiencies. The true solution lies in removing the burden, not redistributing it.

When Finance Works, Everyone Wins

At one community health center, leadership decided to streamline its financial operations using a unified accounting system integrated with its EHR. Within months, administrative hours dropped by nearly 25%. Staff no longer spent half their day reconciling spreadsheets or preparing reports manually.

The difference went beyond time saved. Clinicians could focus on patient communication and care coordination, while the finance team had real-time visibility into budgets and expenses. The change didn’t just improve processes; it reshaped morale. Staff reported feeling more connected to the center’s mission because they finally had time to deliver on it.

Turning Time Into Care

Every hour reclaimed from manual work is an hour reinvested in patients. That could mean following up with families who miss appointments, planning community outreach, or simply spending more time listening. Operational efficiency directly affects quality of care, and that’s something automation and streamlined workflows can deliver without hiring additional staff.

With a single integrated system, data moves automatically between departments, eliminating the back-and-forth emails and duplicated tasks that consume hours each week. Suddenly, financial management becomes invisible, a silent enabler of better care delivery.

Building a Culture That Values Time

Technology alone doesn’t fix time constraints; mindset does. Successful FQHCs make efficiency part of their culture. They encourage staff to question outdated processes, invite input from different departments, and view automation as a tool for empowerment.

The result is a workplace where people spend more time serving patients and less time serving spreadsheets. This shift creates not only better outcomes but also stronger staff retention, because employees feel their work aligns with their mission, not just their job description.

Partnering for Sustainable Change

At Lavoie CPA, we help FQHCs redesign their financial systems so people can focus on what truly matters. From integrating automated accounting solutions to aligning financial reporting with patient outcomes, our goal is simple: to give your team back time for care.

If your staff is stretched thin and you’re ready to turn operational stress into clinical impact with outsourced accounting services, start the conversation with Lavoie CPA today.

by Sharai Lavoie | Nov 13, 2025 | Federally Qualified Health Centers

Federally Qualified Health Centers (FQHCs) are under constant pressure to do more with fewer resources. Between compliance deadlines, complex funding streams, and growing patient needs, administrative teams are often overwhelmed. The good news? Many of those hours spent managing spreadsheets, reconciliations, and manual reporting can be reclaimed through automation.

Financial automation isn’t about replacing people; it’s about giving your team back the time they need to focus on strategy, compliance, and patient outcomes. This playbook breaks down how to build a smarter, more efficient financial operation in your FQHC.

Step 1: Identify Manual Bottlenecks

Start by understanding where your team spends the most time. It’s usually in reconciliations, journal entries, or report consolidation, tasks that require precision. These are perfect candidates for automation.

At Lavoie CPA, we often find that FQHCs lose between 10 and 20 hours per month reconciling accounts across different systems. Automating these steps can instantly improve productivity, accuracy, and morale. The goal here isn’t just speed, it’s consistency. When data flows automatically and accurately, there is trust in the financial data provided.

Step 2: Automate Key Financial Processes

Once you’ve identified bottlenecks, begin automating the most repetitive tasks. Platforms like Sage Intacct allow for rule-based approvals, recurring journal entries, and automatic imports from banking or revenue cycle management systems.

Automation ensures that key workflows, like payables, revenue recognition, and reporting, run reliably without daily oversight. The result is faster closings, cleaner data, and fewer late nights for your accounting staff. It also gives your organization a single source of truth, which is essential when reporting to funders and HRSA.

Step 3: Connect Automation With Insights

Automation is most valuable when it feeds into decision-making. Once processes are running smoothly, the next step is to use the real-time data they generate to track operational performance.

For example, connecting your financial platform to encounter data allows you to analyze average revenue per visit and identify payer trends instantly. This integration helps you understand your revenue and where you need to focus. Visibility into these metrics turns your automation investment into actionable conversations, supporting smarter allocation of limited resources.

Step 4: Measure and Communicate Impact

Efficiency gains mean little if they aren’t visible to leadership. Track measurable improvements after automation, like hours saved per month, faster report turnaround, or reduced compliance errors. Presenting this data demonstrates ROI and reinforces the value of automation as a long-term strategy.

The more your leadership sees the operational benefits, the easier it becomes to expand automation to other areas like budgeting, grant tracking, and forecasting. It also helps build a culture where technology and efficiency are viewed as enablers of mission success, not obstacles to it.

Step 5: Build for the Future

Automation isn’t a one-time project, it’s a mindset. As your systems mature, you’ll find new opportunities to streamline tasks and eliminate redundancies. Partnering with a team that understands both financial operations and FQHC compliance ensures that every improvement stays aligned with your regulatory obligations and your mission.

At Lavoie CPA, we help FQHCs assess automation opportunities, implement cloud-based systems like Sage Intacct, and connect financial and operational data for better visibility. The result: less time spent managing data, and more time focused on delivering care.

Start the Conversation

Ready to see how automation can give your team back valuable time? At Lavoie CPA, we help FQHCs transform financial management into a driver of efficiency and insight.

Start the conversation today to explore what automation could mean for your organization.

by Sharai Lavoie | Nov 13, 2025 | Federally Qualified Health Centers

Running a Federally Qualified Health Center (FQHC) often means doing more with fewer hands. Across the country, clinics face staffing shortages that stretch both clinical and administrative teams. Between reporting requirements, financial compliance, and day-to-day patient care, limited staff can quickly feel overwhelming. But while workforce shortages may be inevitable, inefficiency doesn’t have to be.

With the right partner, financial systems, and smarter workflows, FQHCs can maintain stability and continue delivering quality care, even with lean teams.

The Real Impact of Workforce Shortages

When staff capacity drops, the impact goes far beyond scheduling. Manual accounting tasks pile up, reports are delayed, and leaders lose visibility into key numbers. The result is reactive decision-making and mounting stress.

Most FQHCs can’t simply hire their way out of the problem, so the solution lies in transforming how existing staff work. Streamlined systems, automation, and connected data gives your team the leverage they need to stay efficient and mission-focused, regardless of size.

Automate and Optimize Financial Tasks

Automation is one of the most effective ways to create breathing room when resources are tight. Tools like Sage Intacct take care of time-consuming financial processes, reconciliations, reporting, and data consolidation, so your staff can focus on higher-value activities. By standardizing workflows and reducing manual input, FQHCs can maintain accuracy while cutting hours spent on administrative work.

The benefits extend beyond time savings. Automation delivers consistent, real-time visibility into financial data, helping leaders make quicker, more confident decisions. With fewer errors and less duplication of effort, your organization can close the books faster and maintain compliance without adding extra headcount.

We explore this further in Automating Financial Tasks for Efficiency.

Free Your Team to Focus on Patient Care

When staff are stretched thin, even small inefficiencies can compound into burnout. A direct care teams shouldn’t be chasing invoices or reconciling budgets, and your finance team shouldn’t be drowning in manual spreadsheets. By outsourcing accounting tasks or implementing standardized workflows, you give your people the freedom to return their focus to patient service delivery.

This shift doesn’t just reduce stress; it improves patient outcomes. When staff spend more time connecting with patients and less time buried in reports, satisfaction and retention both rise. FQHCs that realign their processes around care rather than paperwork see measurable improvements in engagement and efficiency.

Learn more about this in Freeing Staff to Focus on Patient Care.

Turn Data Into Actionable Insights

Having fewer people doesn’t mean having less control; it just means you need clearer information. Real-time dashboards that integrate operational metrics like encounters, payer mix, and average revenue per visit help leaders anticipate financial trends instead of reacting to them. With the right visibility, your team can identify issues early, adjust spending, and allocate resources where they’re needed most.

Actionable data transforms uncertainty into confidence. When decision-makers have access to accurate, connected information, they can make timely choices that stabilize operations. It’s not about more reports, it’s about smarter ones.

We expand on this concept in Turning Data Into Actionable Insights.

The Shift From Overwhelmed to Empowered

Workforce shortages aren’t going away soon, but they don’t have to define your organization’s limits. FQHCs that adopt automation, smarter processes, and real-time visibility can remain agile and sustainable even with smaller teams. The goal isn’t to replace people, it’s to empower them with the right tools so every hour counts and every decision adds value.

At Lavoie CPA, we help FQHCs reduce administrative burden, connect financial and operational data, and build systems that support long-term growth.

If you’re ready to strengthen your center’s resilience, start the conversation.

by Sharai Lavoie | Sep 24, 2025 | Accounting, Big Data, Uncategorized

As a growing business, you rely on up-to-date financial information to make strategic decisions, but without the right structure in place, even the most detailed numbers can feel like guesswork. If your Chart of Accounts is cluttered or your reporting lacks the depth you need, you’ll struggle to answer questions like “Which product line drives our margins?” or “How did that marketing campaign impact revenue by region?”

Fortunately, by thoughtfully designing your Chart of Accounts and layering on reporting dimensions, you can transform raw data into meaningful insights, creating a financial framework that grows with you.

1. The Role of Your Chart of Accounts

The Chart of Accounts is the structural framework that categorizes every transaction within your accounting system. An optimized CoA should:

- Group similar accounts: Avoid dozens of minor variations by consolidating them under clear categories (e.g., “Advertising and Marketing Expenses” rather than separate accounts for each campaign tool).

- Support consistency: Use clear naming conventions and numbering to ensure every team member records transactions uniformly.

- Reduce clutter: Revenue, expense, assets, and liability accounts should be aggregated as best as possible so that immaterial transactions are not standing alone in their own accounts.

- Design for permanence: Because accounts with activity can’t simply be deleted without affecting history, plan ahead for roll-ups and consolidations. When change is needed, deactivate the account and reclassify past entries to maintain historical integrity.

When your CoA is organized, analyzing financial results, especially when comparing to budgets and forecasts, should be seamless and efficient for reporting to management, investors, and third-party stakeholders.

2. Introducing Reporting Dimensions

Standard accounts tell you what happened; dimensions tell you where, why, and how much across multiple perspectives. Dimensions work like tags that can be attached to any transaction, such as:

- Department (e.g., Sales, R&D)

- Location (e.g., North America, EMEA)

- Project or Job (e.g., Project Alpha, Client Engagement)

- Product Line (e.g., Subscription, Professional Services)

These dimensions allow you to analyze the income statement, balance sheet, and cash flow data in countless ways, without adding to your CoA. High-quality accounting systems can handle multiple dimensions and provide tools for instantly reporting dimensional financial data.

Important: To keep reports comparable over time, make dimension coding mandatory for every transaction and keep the taxonomy intentionally simple (fewer, well-defined values reduce mis-coding and friction for users).

3. Key Benefits of Dimensions

Real-time visibility

Instantly view revenue and expense trends by any combination of dimensions.

Budget vs actual comparability / Transparent reporting

Forecast models should align with the accounting CoA so that analyzing and reporting variances is fast and efficient. For instance, budgets should compute payroll expense by department, which should align with the actual payroll expenses that are reported monthly from the accounting system. This alignment allows for effective analysis of variances.

Driver-based forecasting

Link key business drivers (like headcount or memberships) to dimensions, and build forecasts that align with the underlying assumptions.

Scenario analysis

Model “what-if” scenarios (for example, the impact of headcount changes in the Sales department and expected impact on revenue and cost of acquiring customers (CAC)) and see immediate impact of the forecast/ budget.

Scalability

Add new dimensions as your business grows, new products, regions, or programs, without overhauling your account structure.

4. Implementing Your CoA & Dimension Strategy

Step 1: Organize and Simplify Your CoA

- Review existing accounts: merge or retire duplicates.

- Use standardized account numbering (e.g., Assets 1000 – 1999, Liabilities 2000 – 2999).

- Include gaps in the numbers for future expansion of the chart of accounts when needed.

- Plan for change without breaking history: If you retire or consolidate accounts that already have posted activity, set them to inactive and reclassify historical transactions rather than deleting.

Step 2: Define Critical Dimensions

- Engage department heads to identify the 4–6 dimensions that drive strategic insight.

- Document tagging rules and default values to ensure consistency.

- Require coding on every transaction: Establish which dimensions are mandatory across transaction types; provide defaults where appropriate, and define QA checks to prevent un-coded entries.

Step 3: Configure Sage Intacct

- Enable selected dimensions in system settings.

- Designate required dimensions for specific transaction types and enforce posting controls so entries can’t be saved without the right codes.

- Train finance and operations teams on proper tagging procedures and ensure integrations also pass required dimension values.

Step 4: Build Dynamic Dashboards and Reports

- Use Sage Intacct’s Report Writer to create P&L and balance sheet views by dimension.

- Set up real-time dashboards in Intacct’s Home dashboard for executive visibility.

5. From Data to Decision-Making

Once configured, your CoA and dimensions become the backbone of strategic finance:

- Empower leaders with tailored reports by region, product, or project, without waiting for monthly close.

- Align budgets and actuals seamlessly, enabling proactive adjustments.

- Tell a compelling story around performance, backing every recommendation with precise, dimension-driven data.

6. Other Reminders

- COA decisions are durable. Once an account has posted transactions, it cannot be cleanly removed. If you need to retire or consolidate it, mark it inactive and reclassify historical transactions to preserve accurate reporting.

- Dimensions require discipline. When you introduce dimensions, every transaction must be coded with the required values. Keep the dimension set intentional and simple so coding stays consistent and reporting remains clear.

A well-structured Chart of Accounts combined with Sage Intacct’s reporting dimensions transforms raw numbers into actionable intelligence. By implementing this framework, you’ll accelerate close processes, deepen financial insights, and equip your organization to respond swiftly to change.

Start the conversation.