by Mark Colwell | Jan 7, 2019 | Uncategorized

As moving to the cloud becomes less a matter of “if” and more a matter of “when” for most companies, the follow-up question is how best to go about doing so. This article identifies several key goals or opportunities companies will want to focus on as they enter into this process.

by Mark Colwell | Jan 3, 2019 | Uncategorized

Cybersecurity is a critical issue at Microsoft, as it is for organizations everywhere. Microsoft processes more than 400 billion emails each month and stops over 10 million malicious emails every minute to keep their users safe and secure on the cloud. Your business can leverage the same solution to provide a secure and agile workplace for your employees. Contact us for more information.

View: Office 365 helps secure Microsoft from modern phishing campaigns

by Mark Colwell | Jan 3, 2019 | Uncategorized

People need solutions that are easy to use and provide a great customer experience. Microsoft has made this a core tenant of solution usability. With products like Azure Data Factory, Azure Data Lake, and SQL Server Analysis Services, Microsoft has created a data platform that allows them to collaborate and scale. Contact us to find out how we can help you integrate this same tech.

View: Microsoft uses analytics and data science to enhance the user experience

by Mark Colwell | Jan 2, 2019 | Uncategorized

To receive updates from Lavoie CPA, and to learn more about how we can help with Microsoft 365, subscribe today!

View: Don’t miss another post from Lavoie CPA

by Mark Colwell | Jan 2, 2019 | Uncategorized

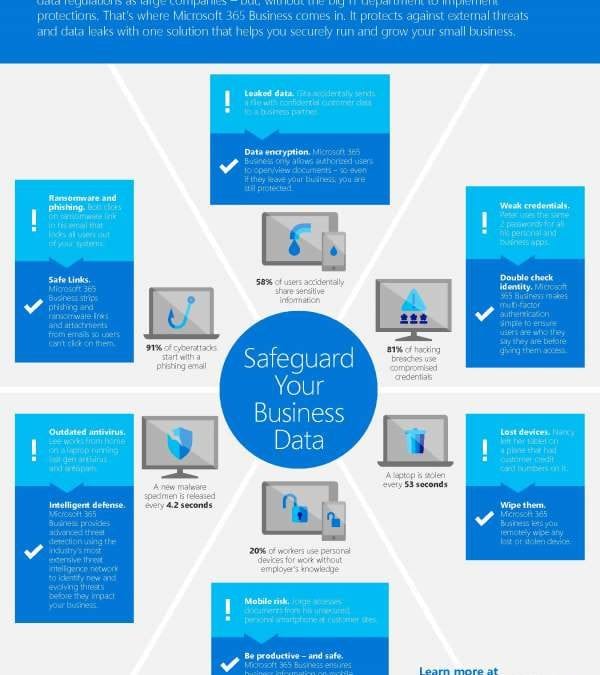

This infographic outlines common security breach scenarios caused by human error and the ways in which Microsoft 365 is addressing these problems through built-in security protocols.

View: SMB security: infographic